In today’s fast-paced financial world, staying on top of your bank balance is crucial for effective money management. First Abu Dhabi Bank (FAB), one of the UAE’s leading financial institutions, offers various convenient methods for customers to check their account balances. Whether you’re a tech-savvy individual or prefer traditional banking methods, FAB has you covered. This comprehensive guide will walk you through everything you need to know about checking your FAB bank balance, from online methods to ATM inquiries.

5 Quick & Easy Steps for Fab Balance Check

- Step 1: Log in to the FAB Bank Online

- Step 2: Navigate to Your Account Information

- Step 3: Check Your ATM Balance

- Step 4: Review Your Recent Transactions

- Step 5: Log Out

Understanding FAB Bank

Before we dive into the specifics of balance checking, let’s take a moment to understand what FAB is all about. First Abu Dhabi Bank, formed from the merger of National Bank of Abu Dhabi (NBAD) and First Gulf Bank (FGB), has established itself as a cornerstone of the UAE’s banking sector. With a wide range of services catering to personal and corporate banking needs, FAB has become synonymous with reliability and innovation in the financial industry.

- More to read: Mahzooz Draw

Why Regular Balance Checks Matter

Keeping a close eye on your bank balance is more than just a good habit – it’s an essential practice for maintaining financial health. Regular balance checks allow you to:

- Track your spending patterns

- Detect unauthorized transactions early

- Avoid overdraft fees

- Plan your budget more effectively

- Ensure your salary and other deposits are credited correctly

Now, let’s explore the various methods FAB offers for checking your account balance.

Methods to Check Your FAB Bank Balance

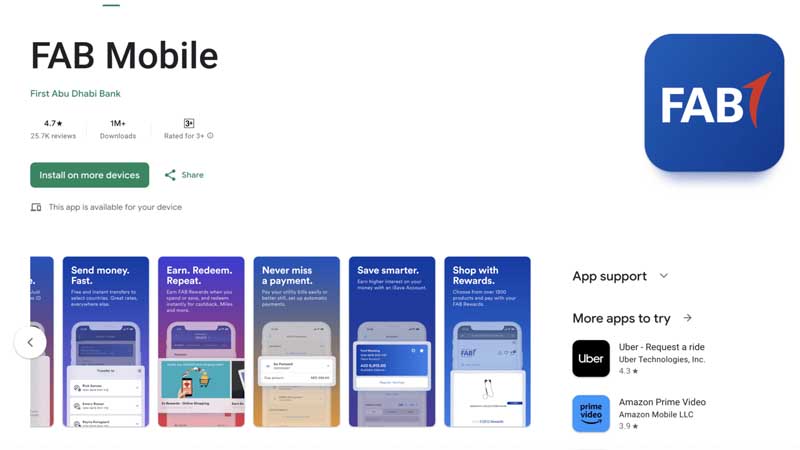

1. FAB Mobile Banking App

The FAB Mobile Banking App is perhaps the most convenient way to check your balance on the go. Here’s how to use it:

- Download the app from your device’s app store (available for both iOS and Android)

- Open the app and log in using your credentials

- Once logged in, your account balance should be visible on the main dashboard

- For more detailed information, tap on the specific account you want to check

The app offers additional features like transaction history, fund transfers, and bill payments, making it a comprehensive tool for managing your finances.

- More to read: UAE Public Holidays 2024

2. FAB Online Banking Portal

For those who prefer using a computer, the FAB Online Banking Portal is an excellent option:

- Visit the official FAB website

- Click on the “Login” button for online banking

- Enter your username and password

- After logging in, you’ll see your account summary, including balances for all your accounts

- Click on any account for more detailed information and recent transactions

3. ATM Balance Inquiry

If you’re near a FAB ATM or any compatible ATM, you can easily check your balance:

- Insert your FAB debit card into the ATM

- Enter your PIN when prompted

- Select the “Balance Inquiry” option from the menu

- Your current balance will be displayed on the screen

- You may also have the option to print a mini-statement

4. SMS Banking

FAB’s SMS banking service allows you to check your balance without internet access:

- Ensure you’re registered for FAB’s SMS banking service

- Send a balance inquiry SMS to the number provided by FAB (format may vary, so check with the bank for the correct format)

- You’ll receive an SMS with your current balance

5. Phone Banking

For those who prefer speaking to a representative:

- Call the FAB customer service hotline

- Follow the automated menu prompts or speak to a representative

- You may need to verify your identity

- Request your current balance

Setting Up FAB Mobile Banking

To make the most of FAB’s digital services, setting up mobile banking is a great start. Here’s how:

- Download the FAB Mobile Banking App

- Open the app and select “Register”

- Enter your FAB account or card details for verification

- Create a username and password

- Set up additional security measures like a PIN or biometric login

- Verify your identity through an SMS code or other provided method

- Once verified, you can start using the app to check your balance and manage your account

FAB Salary Account Balance Check

For those with a FAB salary account, checking your balance is similar to regular accounts. You can use any of the methods mentioned above. However, here are some specific tips for salary account holders:

- Set up balance alerts to be notified when your salary is credited

- Use the mobile app or online portal to view your salary credit history

- Check your balance a day or two after your expected salary date to ensure it’s been credited correctly

Security Tips for Online and Mobile Banking

While checking your balance online or through mobile banking is convenient, it’s important to prioritize security:

- Use strong, unique passwords for your banking accounts

- Enable two-factor authentication if available

- Avoid using public Wi-Fi for banking activities

- Regularly update your banking app and device operating system

- Log out of your banking session when finished

- Never share your banking credentials with anyone

Understanding Your FAB Bank Statement

When checking your balance, it’s helpful to understand your bank statement. Here are key elements to look for:

- Opening balance: Your account balance at the start of the statement period

- Deposits: Money added to your account

- Withdrawals: Money taken out of your account

- Fees: Any charges applied by the bank

- Interest: Any interest earned on your balance

- Closing balance: Your account balance at the end of the statement period

FAB’s Additional Financial Services

While checking your balance, you might want to explore other financial services offered by FAB:

- Savings accounts with competitive interest rates

- Investment options for growing your wealth

- Credit cards with rewards programs

- Personal loans for various needs

- Mortgage services for home buyers

Troubleshooting Common Balance Check Issues

Sometimes, you might encounter issues when trying to check your balance. Here are some common problems and solutions:

- Forgotten password: Use the “Forgot Password” option on the login page

- App not working: Try updating the app or reinstalling it

- Unable to access online banking: Contact FAB customer support for assistance

- Discrepancies in balance: Compare your records with the bank statement and contact FAB if issues persist

The Importance of Financial Literacy

Understanding how to check your balance is just one aspect of financial literacy. FAB often provides educational resources to help customers better manage their finances. Take advantage of these resources to improve your financial knowledge and make informed decisions about your money.

Future of Banking: What’s Next for Balance Checks?

As technology evolves, so do banking services. FAB continues to innovate, potentially introducing new ways to check your balance in the future. Keep an eye out for:

- Voice-activated balance checks through smart home devices

- Augmented reality banking apps

- Blockchain-based real-time balance updates

- AI-powered financial assistants

FAB Cashback Offer Salaried Persons

Fab-ulous Finances: Revolutionizing Your Banking Experience

In the ever-evolving realm of financial services, a paradigm shift is underway. By simply setting up a FAB account and using FAB Mobile, you can earn up to AED 5,000 in cashback! This groundbreaking opportunity is reshaping the landscape of personal banking, offering a tantalizing blend of convenience and rewards.

Imagine a world where your mundane financial transactions metamorphose into a wellspring of benefits. It’s effortless to get started – just download the FAB Mobile app and transfer your salary. Even if you’re already ensconced in the FAB ecosystem, this cornucopia of cashback awaits you. If you already have a FAB account, you can still participate in this exciting offer by moving your salary there.

|

Earnings |

Cashback (UAE National) | Cashback (Expatriate) |

| AED 0 – 2,999 | 0 |

0 |

|

AED 3,000 – 4,999 |

Up to AED 1,000 | Up to AED 500 |

| AED 5,000 – 14,999 | Up to AED 2,500 |

Up to AED 1,500 |

| AED 15,000+ | Up to AED 5,000 |

Up to AED 2,500 |

The mechanism is brilliantly straightforward: The process is simple: once two or more salaries are transferred to your FAB account, you become eligible to receive the cashback. This egalitarian approach ensures that both UAE nationals and expatriates can partake in this financial fiesta. As a UAE National, you could earn up to AED 5,000 in cashback, while expatriates can earn up to AED 2,500.

But wait, there’s more! The cashback you earn will be credited to your account as FAB Rewards. These aren’t just arbitrary points – they’re a versatile currency in their own right. Now, here’s the exciting part – you can use these FAB Rewards to shop at your favorite brands, conveniently pay utility bills, handle Salik payments, or even redeem them as cashback directly into your account!

Frequently Asked Questions

To address some common queries about FAB bank balance checks, here’s a helpful FAQ section:

Q1: How often should I check my FAB bank balance?

A: It’s recommended to check your balance at least once a week, or more frequently if you have a lot of transactions.

Q2: Is it safe to check my balance using public Wi-Fi?

A: It’s best to avoid using public Wi-Fi for any banking activities. If necessary, use a secure VPN connection.

Q3: Can I check my FAB balance if I’m traveling internationally?

A: Yes, you can use the FAB mobile app or online banking portal as long as you have internet access. Make sure to inform FAB of your travel plans to avoid any account restrictions.

Q4: What should I do if I notice an unauthorized transaction when checking my balance?

A: Contact FAB’s customer service immediately to report the unauthorized transaction and follow their guidance on securing your account.

Q5: Are there any fees for checking my FAB bank balance?

A: Generally, there are no fees for checking your balance through digital channels or ATMs. However, some services like printed statements might incur a fee.

Q6: Can I check the balance of multiple FAB accounts at once?

A: Yes, if you have multiple accounts linked to your online or mobile banking profile, you can view all balances on a single dashboard.

Q7: How accurate is the balance shown in online and mobile banking?

A: The balance shown is typically up-to-date, but some recent transactions might take time to reflect. Always consider any pending transactions when reviewing your balance.

In conclusion, FAB Bank offers a variety of convenient and secure methods for checking your account balance. Whether you prefer digital solutions like mobile apps and online banking, or traditional methods like ATM inquiries and phone banking, FAB has options to suit every preference. Regular balance checks are an essential part of managing your finances effectively, helping you stay on top of your spending, avoid fees, and make informed financial decisions.

By understanding the various ways to check your balance and following best practices for security, you can make the most of FAB’s banking services and take control of your financial health. Remember, your bank balance is more than just a number – it’s a key indicator of your financial well-being and a tool for achieving your financial goals.

Pool Tiles

Pool Tiles